Pondy Oxides & Chemicals Ltd (NSE: POCL), the country’s largest lead and lead alloys producer, surged more than 10 per cent in Monday’s trading to ₹1,257.40, marking a breakout that has drawn fresh attention from investors betting on India’s evolving electric vehicle supply chain.

The mid-cap stock, which has climbed nearly six-fold since early 2023, is now testing resistance levels last seen at the peak of its 2024 rally. Market watchers say the move is backed by strong volumes and a steady improvement in fundamentals, positioning the company as a notable beneficiary of the global shift toward battery recycling and sustainable manufacturing.

Battery Recycling Tailwind

POCL has long supplied lead and alloys to India’s battery majors, including Amara Raja and Exide. More recently, it has accelerated investments in recycling and circular economy initiatives, aligning with government priorities on reducing imports of critical materials.

Exports, which account for a rising share of revenue, now reach more than 15 countries. Analysts argue that this global footprint offers a degree of insulation from domestic commodity cycles.

Strong Balance Sheet, Reasonable Valuation

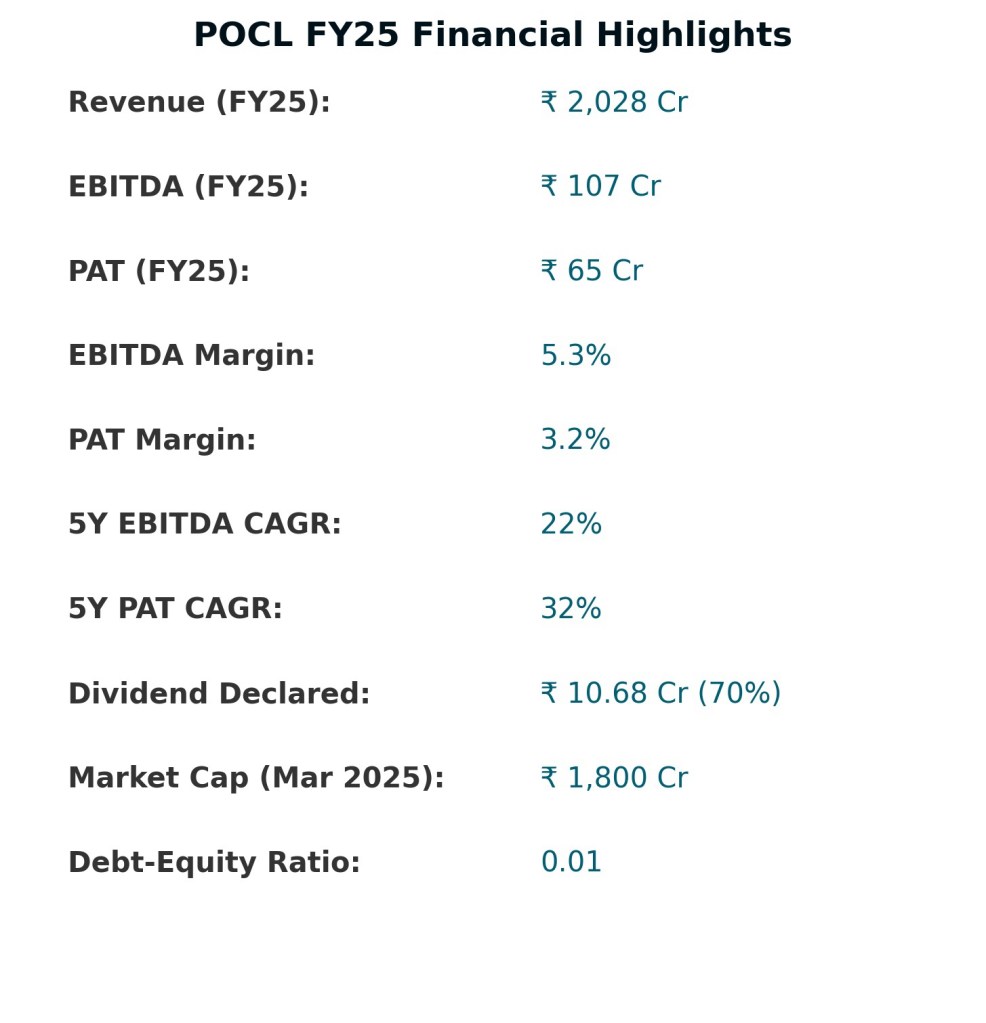

The company’s financial profile underpins investor confidence. With a return on capital employed approaching 20 per cent and promoter holding of over 70 per cent, POCL trades at a modest earnings multiple — roughly 10 to 12 times trailing earnings — well below many specialty chemical peers.

“Valuation remains attractive relative to growth prospects, particularly given the scale of expansion in the recycling segment,” said one Mumbai-based analyst with a domestic brokerage.

Technical Picture

On the charts, the stock’s breakout has been accompanied by a sharp rise in trading volume, a pattern often viewed as confirmation of institutional participation. If sustained, the rally could carry the stock toward the ₹1,400–₹1,600 range, analysts noted, though profit-taking is likely near historical highs.

Outlook

The near-term performance will hinge on execution in recycling, continued demand from the automotive sector, and any policy incentives under the government’s green manufacturing agenda. Longer term, investors are watching for a potential foray into lithium recycling, which could redefine the company’s positioning in the EV supply chain.